Condo Insurance in and around Manhattan

Welcome, condo unitowners of Manhattan

Protect your condo the smart way

- Beecher

- Monee

- Steger

- S Chicago Heights

- Chicago Heights

- Dyer

- Frankfort

- Mokena

- Orland Park

- New Lenox

- Tinley Park

- Matteson

- Park Forest

- Grant Park

- Manteno

- Peotone

- Manhattan

- Elwood

- Channahon

Your Possessions Need Protection—and So Does Your Townhome.

Because your condo is the place you call home, there are some key details to consider - future needs, home layout, needed repairs, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you excellent insurance options to help meet your needs.

Welcome, condo unitowners of Manhattan

Protect your condo the smart way

State Farm Can Insure Your Condominium, Too

Your home is more than just a structure. It's a refuge for you and your loved ones, full of your personal possessions with both sentimental and monetary value. It’s all the memories attached to every room. Doing what you can to help keep it safe just makes sense! That's why one of the most sensible steps is getting a Condominium Unitowners policy from State Farm. This protection helps cover a variety of home-related mishaps. For example, what if a fire damages your unit or a gas leak causes a fire? Despite the loss or annoyance from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Nick Fellers who can help you file a claim to help assist paying for your lost items. Preparing doesn’t stop troubles from finding you. Coverage from State Farm can help get your condo back to its sweet spot.

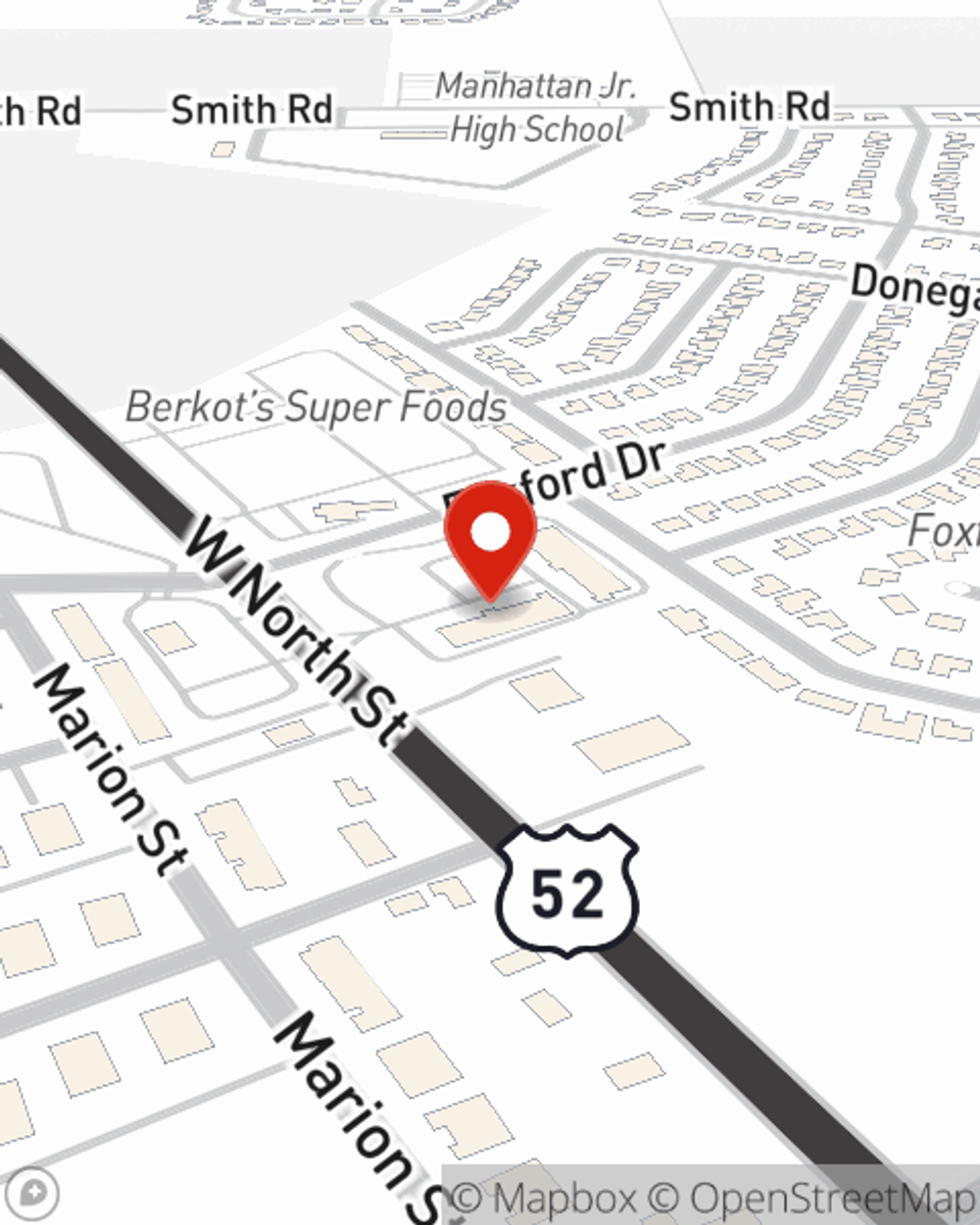

Getting started on an insurance policy for your condo is just a quote away. Stop by State Farm agent Nick Fellers's office to check out your options.

Have More Questions About Condo Unitowners Insurance?

Call Nick at (708) 672-6644 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Nick Fellers

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.